- 10 Ehrlich, Campbelltown, NSW 2560

- +61 430 199 695

- Mon - Fri: 9:00am - 5:00pm

What is an Offset Account?

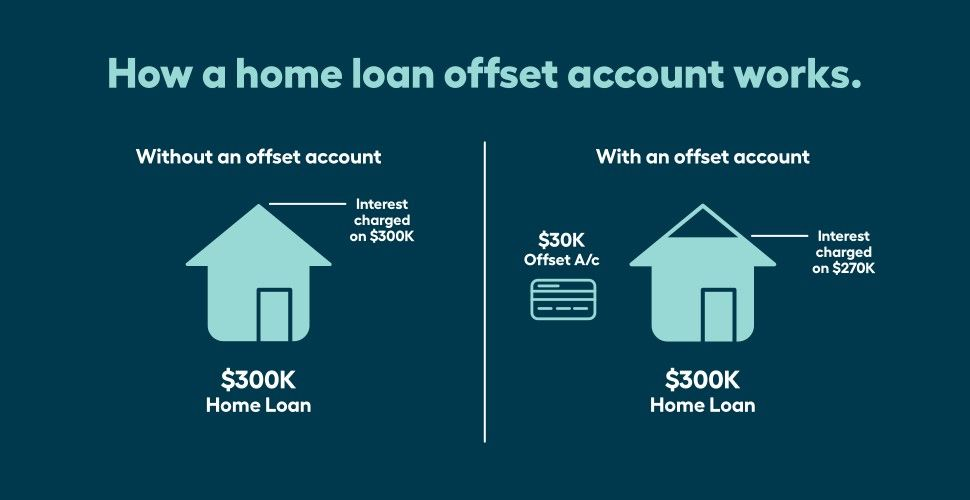

An offset account is a transaction or savings account linked to your home loan. Instead of earning interest, the balance in this account reduces the amount of your mortgage on which interest is charged.

For example:

- If your mortgage is $500,000 and you have $50,000 in your offset account, the lender calculates interest on $450,000 instead of the full loan amount.

This allows you to reduce the overall interest paid on your loan, without locking your funds away.

How Does It Work?

Interest on home loans is calculated daily and charged monthly. The more money you have in your offset account, the lower your daily loan balance becomes for interest calculation purposes.

Unlike making additional repayments into your loan, which may not be easily accessible, offset accounts allow you to retain full access to your money at any time.

The account functions like a standard everyday account, but instead of earning minimal interest, it saves you a significant amount in loan interest.

Benefits of Using an Offset Account

1. Interest Savings

Every dollar in the offset account directly reduces the portion of your loan that accrues interest. Over time, this can translate to substantial savings.

2. Faster Loan Repayment

Since less of your repayment is being used to cover interest, more goes toward the loan principal. This helps you repay the mortgage sooner, even without increasing repayment amounts.

3. Access to Funds

Offset accounts provide convenient access to your funds, unlike making direct extra repayments to your loan, which may require redraw requests and approval.

4. Tax Efficiency for Investors

If you plan to convert your home into an investment property, keeping your savings in an offset account preserves the tax deductibility of the loan interest — something that could be impacted if you pay off the principal early.

100% vs Partial Offset Accounts

Offset accounts are available in two forms:

| Feature | 100% Offset Account | Partial Offset Account |

|---|---|---|

| Loan Balance Offset | Full balance in the account offsets the loan | Only a portion (e.g., 40% or 50%) offsets the loan |

| Common Loan Type | Typically available with variable-rate loans | Often paired with fixed-rate loans |

| Interest Savings | Higher potential savings | Lower savings due to reduced offset effect |

| Flexibility | Greater overall benefit | Limited advantage compared to 100% offset |

Which Banks Offer Offset Accounts in Australia?

Most Australian banks and lenders provide offset account options, but the structure and eligibility criteria can vary.

Examples include:

- Commonwealth Bank: Offers full offset with eligible variable loans.

- ANZ: Simplicity PLUS and Standard Variable loan options.

- NAB: Tailored loan packages include offset functionality.

- Westpac: Offers Rocket Repay home loan with full offset.

- Macquarie, ING, AMP, Bankwest, Suncorp: Each has variations of offset accounts.

For clients seeking Islamic finance, lenders like Hejaz or Meezan offer alternatives to interest-based products while maintaining similar benefits.

Is an Offset Account Right for You?

An offset account may be ideal if you:

- Have regular income or a lump sum saved

- Want to reduce interest while keeping your funds accessible

- May convert your home into an investment property in the future

- Prefer flexibility over committing extra repayments to the loan

However, there are some things to consider:

- Offset loans can carry slightly higher interest rates or account fees

- You must maintain a balance in the account for it to have an impact

How HR Mortgage & Finance Can Help

At HR Mortgage & Finance, we go beyond interest rate comparisons. Our brokers:

- Identify which lenders offer the best offset account features

- Tailor solutions based on your cash flow, goals, and property plans

- Assist with Islamic finance clients seeking interest-free alternatives

- Ensure you understand the difference between redraw, offset, and extra repayments

We guide you through every aspect of offset account use, helping you make informed, strategic decisions.

Final Thoughts

Offset accounts are a valuable financial tool. When used effectively, they can:

- Significantly reduce the interest you pay over the life of your loan

- Give you more control over your money

- Accelerate your path to becoming mortgage-free

If you want to explore whether an offset account is right for you, our experienced team at HR Mortgage & Finance is ready to help.

Book a consultation today and find out how much you could save.